Understanding the Money Game

Are you intrigued by the world of finance and investment? Do you want to learn how to watch the money game and make informed decisions? Whether you’re a beginner or an experienced investor, this guide will provide you with a comprehensive overview of how to navigate the financial markets and keep a close eye on your investments.

Choosing the Right Platform

Before you dive into the money game, it’s essential to choose the right platform to track your investments. There are numerous online platforms available, each offering unique features and tools. Some popular options include ETRADE, TD Ameritrade, and Fidelity. Consider the following factors when selecting a platform:

-

Commissions and fees: Look for a platform with low or no commissions, as this can significantly impact your returns over time.

-

Tools and resources: Choose a platform that offers a variety of tools and resources, such as stock screeners, technical analysis, and educational content.

-

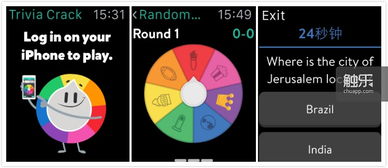

Mobile app: Ensure the platform has a user-friendly mobile app, as you may need to monitor your investments on the go.

Understanding Financial Statements

One of the most crucial aspects of watching the money game is understanding financial statements. These documents provide a snapshot of a company’s financial health and performance. Here’s a breakdown of the key financial statements:

-

Income statement: This statement shows a company’s revenues, expenses, and net income over a specific period. It helps you understand a company’s profitability.

-

Balance sheet: This statement provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It helps you assess a company’s financial stability.

-

Statement of cash flows: This statement shows how a company generates and uses cash over a specific period. It helps you understand a company’s liquidity and cash flow management.

Keeping an Eye on Market Trends

Monitoring market trends is crucial for making informed investment decisions. Here are some key factors to consider:

-

Economic indicators: Keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation. These indicators can provide insights into the overall health of the economy.

-

Market indices: Track major market indices like the S&P 500, Dow Jones, and NASDAQ to understand the overall market performance.

-

News and events: Stay updated on news and events that can impact the market, such as political developments, corporate earnings reports, and economic policy changes.

Using Technical Analysis

Technical analysis involves analyzing historical price and volume data to identify patterns and trends. Here are some common technical analysis tools and indicators:

-

Price charts: Use price charts to identify trends, support and resistance levels, and patterns such as head and shoulders, triangles, and flags.

-

Volume: Analyze trading volume to identify periods of strong or weak market activity.

-

Moving averages: Moving averages help smooth out price data and identify trends. Common moving averages include the 50-day, 100-day, and 200-day moving averages.

-

Indicators: Use indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands to gain additional insights.

Staying Informed

Staying informed is crucial for watching the money game. Here are some ways to stay updated:

-

Financial news websites: Visit financial news websites such as Bloomberg, CNBC, and Reuters for up-to-date market news and analysis.

-

Investment blogs and podcasts: Follow investment blogs and podcasts for insights from experienced investors and financial experts.

-

Social media: Follow financial influencers and join online communities to stay connected with the latest market trends and discussions.

Managing Risk

Managing risk is a critical aspect of watching the money game. Here are some strategies to help you mitigate risk:

-

Asset allocation: Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to reduce risk.