Understanding the Importance of Free Cash

Free cash is a crucial financial metric that can significantly impact the health and growth of a business. It represents the cash that a company has after all its operating expenses, capital expenditures, and taxes have been paid. In this article, we will delve into the various aspects of free cash and why you need it for your business.

What is Free Cash?

Free cash is the cash that a company has available to distribute to its shareholders, reinvest in the business, or pay down debt. It is calculated by subtracting capital expenditures and taxes from the operating cash flow. A positive free cash flow indicates that a company is generating more cash than it is spending, while a negative free cash flow suggests that the company is spending more cash than it is generating.

Why Do You Need Free Cash?

1. Investing in Growth: Free cash allows you to reinvest in your business to drive growth. This could involve expanding your operations, investing in new technologies, or acquiring other companies. By reinvesting in your business, you can increase your market share, improve your products or services, and ultimately boost your profits.2. Paying Dividends: Free cash can be used to pay dividends to your shareholders. This can attract more investors to your company and increase its market value.3. Reducing Debt: Free cash can help you pay down your debt, which can lower your interest expenses and improve your financial stability.4. Building a Cash Reserve: Having a cash reserve can provide a buffer against unexpected expenses or economic downturns. It can also give you the flexibility to take advantage of investment opportunities that arise.5. Improving Financial Health: A positive free cash flow is a sign of a healthy business. It indicates that your company is generating enough cash to cover its expenses and invest in its future.

How to Generate Free Cash

1. Increase Sales: The most straightforward way to generate free cash is to increase your sales. This can be achieved by expanding your customer base, increasing your prices, or introducing new products or services.2. Control Costs: Another way to generate free cash is to control your costs. This involves finding ways to reduce expenses without compromising the quality of your products or services.3. Optimize Working Capital: Effective management of your working capital can also help generate free cash. This includes managing your inventory, accounts receivable, and accounts payable efficiently.4. Invest in Fixed Assets: Investing in fixed assets, such as machinery or equipment, can improve your operational efficiency and generate more cash in the long run.5. Leverage Debt: While it’s important to manage your debt carefully, using debt to finance your operations or investments can free up cash that you can use for other purposes.

Measuring Free Cash Flow

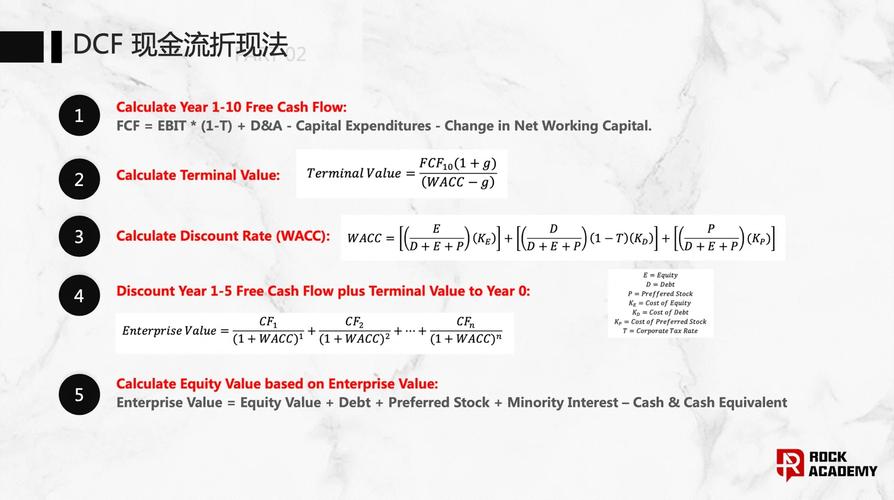

Free cash flow is typically measured on a quarterly or annual basis. To calculate your free cash flow, you can use the following formula:

| Operating Cash Flow | Capital Expenditures | Taxes | Free Cash Flow |

|---|---|---|---|

| $100 million | $20 million | $10 million | $70 million |

In this example, the company has an operating cash flow of $100 million, capital expenditures of $20 million, and taxes of $10 million. Therefore, its free cash flow is $70 million.

Conclusion

Free cash is a vital component of a healthy business. By understanding how to generate and manage free cash, you can ensure the long-term success and sustainability of your company. Remember, the key to generating free cash is to focus on increasing sales, controlling costs, and optimizing your working capital.