Cash Flow Game Financial Statement: A Comprehensive Guide

Understanding the financial health of a business is crucial for its success. One of the most effective tools for this purpose is the cash flow game financial statement. This document provides a detailed overview of a company’s cash inflows and outflows, allowing stakeholders to make informed decisions. In this article, we will delve into the various aspects of the cash flow game financial statement, helping you gain a deeper understanding of its significance and how to interpret it effectively.

What is a Cash Flow Game Financial Statement?

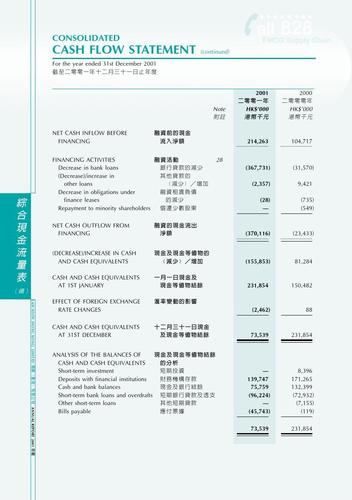

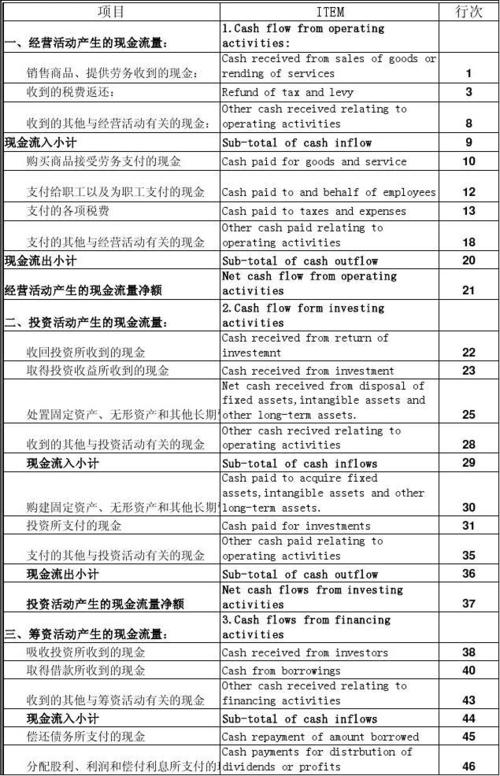

A cash flow game financial statement is a financial report that shows the cash inflows and outflows of a business over a specific period. It is divided into three main categories: operating activities, investing activities, and financing activities. By analyzing these categories, stakeholders can gain insights into the company’s liquidity, solvency, and overall financial performance.

Operating Activities

Operating activities represent the cash generated or used by the company’s core business operations. This section includes cash received from customers, cash paid to suppliers, and other operating expenses. Analyzing this section helps stakeholders understand the company’s ability to generate cash from its primary business activities.

| Operating Activities | Amount ($) |

|---|---|

| Cash received from customers | 1,200,000 |

| Cash paid to suppliers | 800,000 |

| Other operating expenses | 500,000 |

| Total operating cash flow | 500,000 |

Investing Activities

Investing activities involve the purchase and sale of long-term assets, such as property, plant, and equipment, as well as investments in other companies. This section also includes cash received from the sale of assets. Analyzing investing activities helps stakeholders understand the company’s investment strategy and its impact on cash flow.

| Investing Activities | Amount ($) |

|---|---|

| Purchase of property, plant, and equipment | -300,000 |

| Sale of investments | 200,000 |

| Total investing cash flow | -100,000 |

Financing Activities

Financing activities involve the company’s capital structure, including the issuance and repayment of debt, as well as the issuance and repurchase of equity. This section also includes dividends paid to shareholders. Analyzing financing activities helps stakeholders understand the company’s capital structure and its ability to raise funds.

| Financing Activities | Amount ($) |

|---|---|

| Borrowing | 500,000 |

| Dividends paid | -200,000 |

| Total financing cash flow | 300,000 |

Net Cash Flow

The net cash flow is the sum of the cash inflows and outflows from operating, investing, and financing activities. It represents the overall cash position of the company. A positive net cash flow indicates that the company is generating more cash than it is using, while a negative net cash flow suggests that the company is using more cash than it is generating.

Net cash flow = Operating cash flow + Investing cash flow + Financing cash flow

In our example, the net cash flow is calculated as follows:

Net cash flow = $500,000 (Operating cash flow) + (-$100,000) (Investing cash flow) + $300,000 (Financing cash flow) = $600,000