Understanding the Real Cash Apps: A Comprehensive Guide

Cash apps have revolutionized the way we manage our finances, offering a convenient and efficient way to send, receive, and manage money. In this detailed guide, we’ll explore the ins and outs of real cash apps, helping you make informed decisions about which one suits your needs best.

What is a Cash App?

A cash app is a mobile application that allows users to send, receive, and manage money. These apps typically offer features like peer-to-peer (P2P) transfers, bill payments, and even investment options. They have gained immense popularity due to their ease of use and accessibility.

Top Cash Apps to Consider

Here are some of the most popular cash apps available today:

| Cash App | PayPal | Venmo | Google Pay |

|---|---|---|---|

| Point-to-point transfers, Bitcoin trading, Cash Card, and investment options. | Online payments, invoicing, and personal and business accounts. | Peer-to-peer transfers, bill splitting, and social features. | Mobile payments, peer-to-peer transfers, and in-store payments. |

How to Choose the Right Cash App for You

Selecting the right cash app depends on your specific needs and preferences. Here are some factors to consider:

-

Transaction Fees: Some cash apps charge fees for certain transactions, such as sending money internationally or using a credit card for a transfer. Make sure you understand the fees associated with the app you choose.

-

Security: Look for cash apps that offer robust security features, such as two-factor authentication and encryption.

-

Accessibility: Consider the ease of use and availability of the app in your region.

-

Additional Features: Some cash apps offer additional features like investment options, bill payments, and cashback rewards. Determine if these features are important to you.

Top Features of Real Cash Apps

Real cash apps come with a variety of features that make managing your finances easier. Here are some of the most common features:

-

Peer-to-peer Transfers: Send and receive money from friends and family quickly and easily.

-

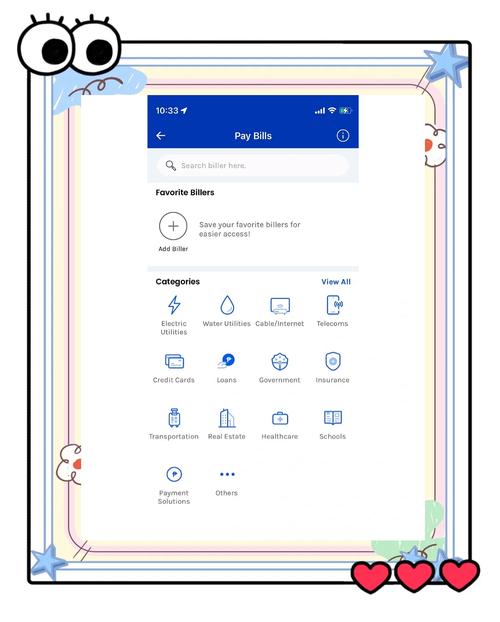

Bill Payments: Pay your bills directly from the app, saving time and reducing the risk of late fees.

-

Investment Options: Some cash apps offer investment options, allowing you to grow your money through stocks, bonds, and other financial instruments.

-

Cashback Rewards: Earn cashback on purchases made through the app.

-

Cash Cards: Some cash apps offer a physical or virtual cash card that can be used for purchases and ATM withdrawals.

How to Get Started with a Cash App

Getting started with a cash app is typically a straightforward process. Here’s a general guide on how to sign up and start using a cash app:

-

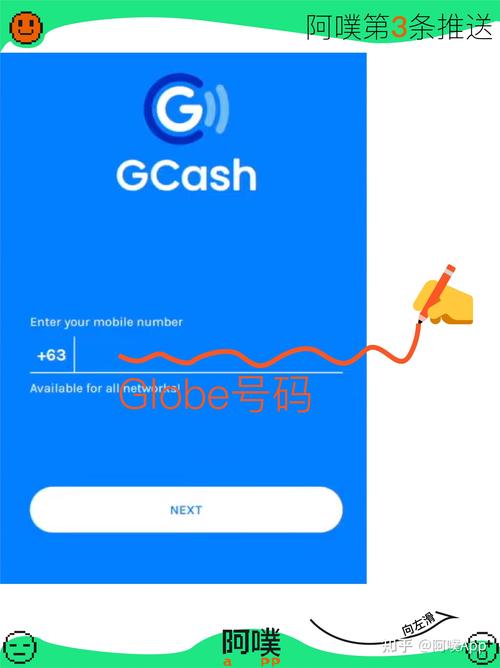

Download the app from your device’s app store.

-

Open the app and create an account by entering your personal information, such as your name, email address, and phone number.

-

Verify your identity by providing a government-issued ID.

-

Link your bank account or credit/debit card to the app.

-

Start using the app to send, receive, and manage your money.

Conclusion

Real cash apps have become an essential tool for managing your finances in today’s digital world. By understanding the features, benefits, and considerations of these apps, you can choose the right one for your needs and take advantage of the convenience and efficiency they offer.