Games to Save Money: A Comprehensive Guide

Are you looking for an engaging way to save money? Look no further! Many people underestimate the power of gaming when it comes to financial management. From budgeting apps to educational games, there are numerous ways to have fun while saving. In this article, we will explore various games that can help you manage your finances effectively.

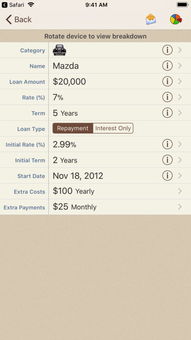

1. Budgeting Apps with Gamification Features

One of the most popular ways to save money is by using budgeting apps. These apps help you track your expenses, set goals, and stay on top of your finances. Some of these apps have gamification features that make budgeting more enjoyable.

| App Name | Platform | Key Gamification Features |

|---|---|---|

| Goodbudget | Android, iOS | Challenge mode, reward points, and visual progress tracking |

| EveryDollar | Android, iOS | Goal setting, progress tracking, and financial milestones |

| YNAB (You Need A Budget) | Web, Android, iOS | Monthly budgeting, envelope system, and financial education |

2. Educational Games for Financial Literacy

Financial literacy is crucial for making informed decisions about your money. There are several educational games that can help you learn about budgeting, investing, and other financial concepts.

1. Mint Financial Literacy Games

Mint offers a variety of games that teach you about budgeting, saving, and investing. These games are designed for different age groups, making them suitable for both adults and children.

2. Khan Academy Personal Finance

Khan Academy provides a comprehensive set of lessons on personal finance, including budgeting, saving, and investing. While not a game, the interactive nature of the lessons makes learning about finances engaging and enjoyable.

3. Investment Simulators

Investing can be a great way to grow your money, but it can also be risky. Investment simulators allow you to practice investing without the risk of losing real money.

1. Robinhood Investment Simulator

Robinhood offers a free investment simulator that allows you to trade stocks, ETFs, and options. This simulator is a great way to learn about the stock market and test your investment strategies.

2. Webull Investment Simulator

Webull is another popular investment simulator that allows you to trade stocks, ETFs, and options. The simulator includes real-time market data and advanced charting tools, making it an excellent tool for experienced investors and beginners alike.

4. Gamified Savings Challenges

Setting savings goals can be challenging, but gamified savings challenges can make the process more enjoyable. These challenges often involve setting a specific savings goal and completing tasks to earn points or rewards.

1. America Saves Savings Challenge

The America Saves Savings Challenge is a 12-month program that helps you set and achieve your savings goals. The challenge includes weekly tasks and rewards, making it easy to stay motivated.

2. SaveUp

SaveUp is a gamified savings app that rewards you for saving money. The app offers various challenges and rewards, including cashback, gift cards, and discounts.

5. Budgeting Games for Kids

Teaching your kids about money management at a young age can set them up for financial success. There are several budgeting games designed specifically for kids that can help them learn about saving, spending, and budgeting.