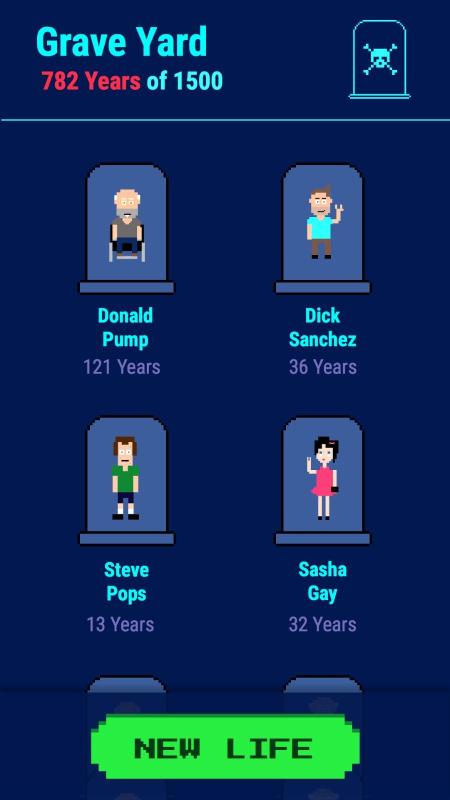

Game of Life Money Calculator: A Comprehensive Guide

Are you ever curious about how much money you’ll need to retire comfortably? Or how much you should be saving each month to achieve your financial goals? The Game of Life Money Calculator is a powerful tool designed to help you answer these questions and more. In this detailed guide, we’ll explore the various dimensions of this calculator, ensuring you have all the information you need to make informed financial decisions.

Understanding the Basics

The Game of Life Money Calculator is a web-based tool that allows you to input your current financial situation, including your age, income, expenses, and savings goals. Based on this information, the calculator provides an estimate of how much money you’ll need to save and invest to achieve your financial objectives.

One of the key features of this calculator is its ability to account for inflation. As you may know, the value of money decreases over time due to inflation. The calculator takes this into account, ensuring that your savings will be able to maintain their purchasing power in the future.

Inputting Your Financial Information

When using the Game of Life Money Calculator, it’s important to input your financial information accurately. Here’s a breakdown of the key data points you’ll need to provide:

- Age: Your current age, which helps the calculator determine your retirement age and the time frame for your financial goals.

- Income: Your current annual income, including any bonuses or overtime pay.

- Expenses: Your monthly expenses, such as rent, utilities, groceries, and entertainment.

- Savings: The amount of money you currently have saved, including any retirement accounts or investments.

- Goals: Your financial goals, such as saving for retirement, buying a home, or paying off debt.

By providing this information, the calculator can generate a personalized financial plan tailored to your specific needs.

Exploring the Results

Once you’ve input your financial information, the Game of Life Money Calculator will provide you with a comprehensive overview of your financial situation. Here are some of the key results you can expect:

- Net Worth: An estimate of your current net worth, taking into account your assets and liabilities.

- Retirement Savings: An estimate of how much you’ll need to save to retire comfortably, based on your current savings rate and expected retirement age.

- Monthly Savings Goal: A recommended amount to save each month to achieve your financial goals.

- Investment Returns: An estimate of the potential returns on your investments, based on historical data and your risk tolerance.

These results can help you identify areas where you may need to adjust your financial strategy, such as increasing your savings rate or reducing your expenses.

Customizing Your Financial Plan

The Game of Life Money Calculator allows you to customize your financial plan to better suit your needs. Here are some of the options available:

- Adjusting Savings Rate: You can experiment with different savings rates to see how it affects your financial goals.

- Changing Investment Strategy: You can adjust your risk tolerance and investment strategy to better align with your financial goals.

- Adding Additional Goals: You can add new financial goals to the calculator and see how they impact your overall plan.

This flexibility allows you to create a financial plan that’s both realistic and tailored to your unique circumstances.

Using the Calculator for Financial Education

In addition to providing personalized financial advice, the Game of Life Money Calculator is an excellent tool for financial education. By using the calculator, you can learn more about the following concepts:

- Compound Interest: Understanding how your savings can grow over time due to compound interest.

- Inflation: Recognizing the impact of inflation on your purchasing power and how to protect against it.

- Risk Management: Learning how to balance risk and reward in your investment strategy.

This knowledge can empower you to make better financial decisions and achieve your long-term goals.

Conclusion

The Game of Life Money Calculator is a valuable tool for anyone looking to gain a better understanding of their financial