Understanding the Income Side: A Comprehensive Guide

When it comes to managing finances, the income side is a crucial aspect that determines your financial health and well-being. In this article, we will delve into the various dimensions of the income side, providing you with a detailed and informative overview.

What is Income?

Income refers to the money or property that an individual or organization earns from work, investments, or other activities. It can also represent the total income of a region or country. Income is a fundamental component of financial management and plays a vital role in determining your financial stability and ability to achieve your goals.

Types of Income

There are several types of income that individuals and organizations can earn. Let’s explore some of the most common ones:

| Type of Income | Description |

|---|---|

| Salary | Regular payments received by an employee for their work. |

| Wage | Payment received by a worker for their labor, usually on an hourly, daily, or weekly basis. |

| Dividends | Payments received by shareholders from the profits of a company. |

| Rental Income | Money earned from renting out property or assets. |

| Investment Income | Earnings generated from investments, such as stocks, bonds, or real estate. |

Calculating Income

Calculating your income is essential for budgeting, tax purposes, and financial planning. Here’s a simple formula to calculate your income:

Income = Total Earnings – Deductions

Total earnings include your salary, wages, dividends, rental income, and any other sources of income. Deductions may include taxes, insurance premiums, and other expenses.

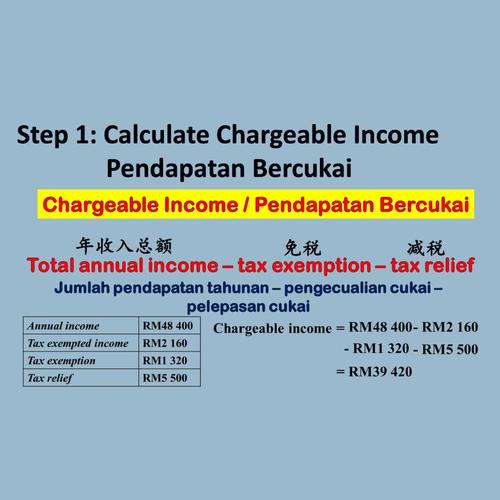

Income Tax

Income tax is a significant aspect of managing your income. It is the amount of tax you owe on your income, which is calculated based on your taxable income and the tax rates applicable to your income level. Understanding how income tax works can help you plan and save effectively.

Increasing Your Income

Increasing your income can help you achieve your financial goals faster. Here are some strategies to consider:

- Seeking promotions or raises at your current job

- Acquiring new skills or certifications to enhance your employability

- Exploring side hustles or freelance opportunities

- Investing in stocks, bonds, or real estate to generate passive income

Income and Financial Planning

Understanding your income is crucial for effective financial planning. Here are some key points to consider:

- Creating a budget based on your income to manage your expenses and savings

- Setting financial goals and prioritizing them based on your income level

- Investing in retirement accounts and other long-term savings vehicles

- Building an emergency fund to cover unexpected expenses

By focusing on the income side of your finances, you can take control of your financial future and achieve your goals with confidence.