Understanding the Book

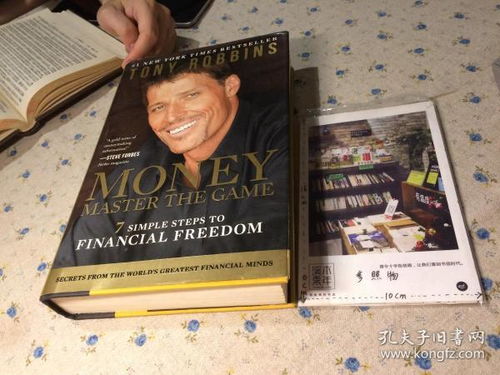

Money Master the Game: 7 Simple Steps to Financial Freedom by Tony Robbins is a comprehensive guide that aims to transform the way you think about money and investing. This book is a result of Robbins’ extensive research and personal experiences in the financial world. It’s a must-read for anyone looking to gain a deeper understanding of personal finance and investment strategies.

Key Takeaways

Here are some of the key takeaways from the book:

| Topic | Summary |

|---|---|

| Financial Education | Robbins emphasizes the importance of financial education and how it can lead to better decision-making. |

| Investment Strategies | The book offers a variety of investment strategies, from stocks to real estate, and how to implement them effectively. |

| Debt Management | Robbins provides insights on how to manage debt and avoid falling into the trap of high-interest loans. |

| Time Value of Money | Understanding the time value of money is crucial for making smart financial decisions. |

Understanding Financial Education

One of the core themes of the book is the importance of financial education. Robbins argues that most people lack the knowledge to make informed financial decisions. He suggests that by educating yourself, you can avoid common pitfalls and create a solid financial foundation.

Robbins believes that financial education should start at a young age. He encourages readers to teach their children about money and investing, emphasizing the value of saving and the power of compounding interest.

Investment Strategies

Money Master the Game delves into various investment strategies, including stocks, bonds, real estate, and more. Robbins provides a detailed analysis of each strategy and offers practical advice on how to implement them effectively.

One of the key strategies Robbins discusses is diversification. He explains how spreading your investments across different asset classes can reduce risk and increase the likelihood of achieving long-term growth.

Debt Management

Debt can be a double-edged sword. While it can be used to finance investments, it can also lead to financial trouble if not managed properly. Robbins offers valuable insights on how to manage debt and avoid falling into the trap of high-interest loans.

He suggests that you should only take on debt for investments that have a high probability of generating a return greater than the cost of the debt. This approach ensures that you’re using debt strategically rather than as a crutch.

The Time Value of Money

Understanding the time value of money is crucial for making smart financial decisions. Robbins explains this concept in detail, emphasizing the importance of starting early and taking advantage of compounding interest.

He suggests that you should focus on building wealth through investments that offer long-term growth potential. By doing so, you can take advantage of the time value of money and create a substantial nest egg over time.

Personal Finance Tips

In addition to investment strategies, Robbins offers a variety of personal finance tips throughout the book. Here are a few highlights:

-

Live below your means: Robbins emphasizes the importance of living within your means and avoiding unnecessary debt.

-

Save regularly: Consistent saving is key to building wealth over time.

-

Invest in yourself: Robbins believes that investing in your own education and personal development is one of the best investments you can make.

Conclusion

Money Master the Game is a valuable resource for anyone looking to improve their financial situation. By following the principles outlined in the book, you can gain a deeper understanding of personal finance and investment strategies, and ultimately achieve financial freedom.